From Principles to Practice: Operationalization of a Global Carbon Market under Article 6

In a whitepaper published by the Oxford Institute of Energy Studies, and in an accompanying podcast discussion with one of her co-authors, Hannah Hauman, Global Head of Carbon Trading at Trafigura, explores how global carbon markets can move from concept to reality.

The report and podcast outline the actions needed to meet rapidly growing demand for regulatory carbon credits by 2030 — from transparent systems and clear regulations to reliable financing. The discussion explores how the balances of international trade are comprised, what the first transactions and trades reveal about the future, and demand forecast for credits to 2030.

Key Insights

- The Article 6 Rulebook and emerging regulatory standards provide a foundation for the first international regulatory market.

- The key challenge is putting the framework into practice – developing the infrastructure, systems and capacity to operate at scale.

- Meeting Paris Agreement commitments will require reducing or removing 11 billion tonnes of emissions for a 2°C pathway and 25 billion tonnes for 1.5°C by 2030.

- While penalties remain the dominant pricing tool, international trade in Article 6 regulatory credits will be critical for cost-efficient decarbonisation.

- Global demand for carbon credits is expected to exceed 700 million tonnes per year by 2030, but supply limitations, bespoke host-country frameworks, and project lead times could create bottlenecks.

Emissions reductions/removals required for 2°C

By 2030

Emissions reductions/removals required for 1.5°C

By 2030

Priorities to Enable Scale

- Interoperable accounting and registry systems

- Robust legal and reporting frameworks

- Precise credit quality assessment and MRV standards

- Scalable financial and risk-transfer solutions; and

- Capacity building in exporting countries.

Together, these measures enable the scalability in trade that the market requires.

Read the white paper here or listen to the podcast here.

Interoperable, transparent accounting and registry systems

Robust legal and reporting frameworks

Precise credit quality assessment and MRV standards

Scalable financial and risk-transfer solutions

Capacity building in exporting countries

Preview some of the charts and data in the paper

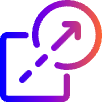

Annual demand for project-generated credits from voluntary, domestic compliance and international compliance markets

Global demand of credits per annum in 2030

As we look to 2030 based on existing regulation, our most conservative forecast for global demand of credits (including voluntary) is over 700Mt per annum (Figure 5 above), signified here across global voluntary, domestic compliance, and international compliance.

Read more in the full paper - Section 7.

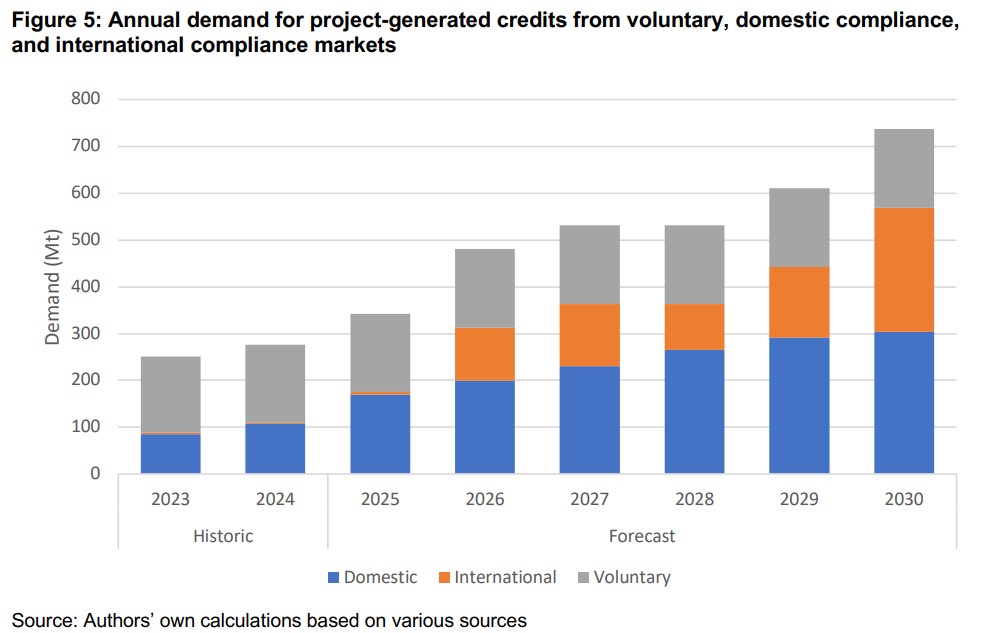

Proportion of Nationally Determined Contributions with unconditional versus conditional targets

Nationally Determined Contributions (NDCs) are the foundation of the Paris Agreement in terms of country-level targets, timelines, and modes of achievement. NDC targets and ambition levels are volunteered by the submitting country every five years which are then aggregated and on a global basis compared to the global ambitions set out by the Paris Agreement. There is naturally a wide range in the scope, specificity, and ambition of NDCs based on country emission profiles, resource endowments, economic and institutional capacity, and intention to engage in trade or collaborate towards emission reduction goals through the transfer of credits.

In line with the Paris Agreement’s call for developed countries to take the lead, OECD countries tend to have more ambitious targets in emission reductions domestically as well as for international trade, and these targets are unconditional by nature. By contrast, countries in the Global South tend to incorporate two components within NDC targets: one unconditional (based on domestic spending and ambition) and one conditional (subject to international finance) - as seen in Figure 1 above.

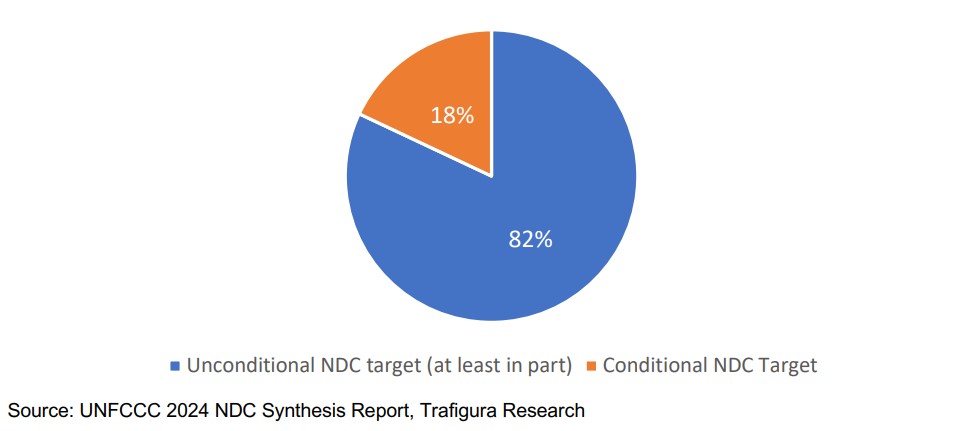

Carbon export levies by country

A Corresponding Adjustment (CA) is effectively the commitment that the exporting country will account for the trade in its balances against its NDC target, thus granting it regulatory status under Article 6 for various market use cases. Host country frameworks for authorising CAs are tending towards bespoke set ups in terms of which projects may apply for a CA, the process of how this is achieved, and the related fee to be applied. Fees or export levies can be charged as a fixed dollar per metric tonne rate, or a variable share of proceeds (revenue share) based on final sales price - as above in Figure 2.