Puma Energy Announces Q2 2022 Results

Group volumes and margins higher versus last quarter

Strong cash flow generation throughout the quarter

Singapore, 25 August 2022 – Puma Energy today announced its quarterly financial results for the three-month period ended 30 June 2022. Overall Group volumes are higher relative to the previous quarter, despite a reduction in volumes in the retail business that is being driven by socio-economic factors associated with the rising costs of energy. In addition, the company saw higher unit margins across all business segments and regions.

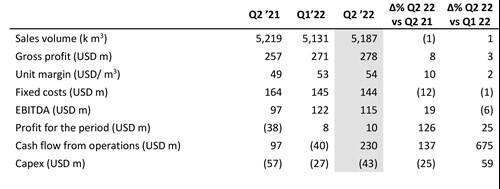

Key Performance Indicators*

*NB All financial figures are presented excluding the impact of IFRS16

*Unadjusted for perimeter changes

Highlights

Health and Safety

Health and safety continues to be a priority. In the quarter, the Lost Time Injury Frequency Rate (LTIFR) was 0.19 including Puma Energy employees and contractors, compared to 0.09 for Q2 2021. This reduction in performance is a result of two Puma Energy employee lost time injuries and two contractor lost time injuries in the year to date. In June, Puma Energy launched its #BePumasafe safety campaign to raise health and safety awareness across the company and emphasise the importance of focusing on leading indicators, such as near miss reporting.

Launch of Sustainability Report

Since the last quarterly update, Puma Energy has published its Sustainability Report detailing its ESG performance in 2021 and setting out a refreshed ESG strategy. Key ambitions detailed in the report are: to reduce Scope 1 and 2 GHG emissions by 15% by end of 2025; to increase the supply of transition fuels and clean energy solutions in Africa to represent 30% of divisional EBITDA by the end of 2027; to achieve zero workplace fatalities and zero significant road traffic accidents and to obtain full alignment with the Voluntary Principles on Security and Human Rights1 by the end of 2024.

Strengthening the business and delivering growth

Puma Energy continued to deliver on its strategy to strengthen its core business by focusing on downstream markets and to evolve by offering new energy solutions. The company continued to invest in sites and actively optimise its network, while delivering on retail offerings that meet the needs of customers in the locations that deliver most value.

This strategy is supporting strong results—total gross margin in the retail business grew from USD 87 million in the second quarter of 2021 to USD 123 million this quarter, on a constant perimeter. The aviation and bitumen businesses continue to recover, driven by increased market demand and new customers in key markets, bringing volumes, gross profits and margins higher relative to Q1 2022.

Puma Energy’s Sustainability Report confirmed an intention to roll out 200 solar projects in 2022. This will help increase the company’s consumption of renewable energy and develop expertise in the deployment of solar energy. In the quarter, the company increased the number of solar power projects in operation by bringing online 20 new projects, taking the total number of solar installations in operation to 121, with an operational capacity of 4.8 MWp.

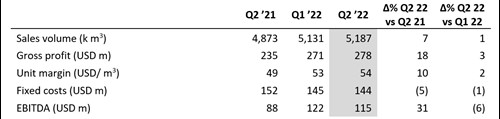

Quarter two 2022 financial performance at a glance

- Gross profit rose from USD 271 million in quarter one to USD 278 million this quarter driven by stronger margins across all segments and regions

- Sales volumes were up 1 per cent at 5,187,000m3 this quarter, up from 5,131,000m3 in Q1 2022

- Unit margins at USD 54 per m3 up slightly on the previous quarter’s performance of USD 53 per m3 and up from USD 49 per m3 relative to the second quarter of 2021

- EBITDA rose to USD 115 million up from USD 88 million in the Q2 2021, on a constant perimeter but was down on the first quarter of 2022, due mainly to foreign exchange impacts on operations

- Fixed costs are flat relative to the first quarter at USD 144 million but down 5% on Q2 2021

- Working capital stood at USD 152 million, up from USD -121 million in the second quarter driven partly by a one-off beneficial timing effect between collection of receivables and payments to suppliers, which will occur out of quarter

- This has resulted in a temporary high-net cash flow from operations of USD 230 million driven by performance and positive working capital

- The level of operating company debt as at the end of the quarter has reduced as a result of performance and timing on working capital

- Senior facilities were reduced by USD 47 million as a result of quarterly amortisation of the company’s five-year term loan, which matures in September 2022

- The one-year RCF amounting to USD 462.5 million and two-year RCF amounting to USD 132.5 million were undrawn at the end of the quarter

Commenting on the results, Carlos Pons CFO, said:

“Puma Energy delivered encouraging results this quarter. Despite challenging market conditions, we saw margins rise across all segments and geographies. The security of supply afforded by our relationship with Trafigura allowed us to increase our overall volumes sold despite product shortages in the global markets. While we are cautiously optimistic about future growth, we remain vigilant to current market volatility and the associated socio-economic impacts. While we have seen reductions in volumes in our retail business as a result of demand contraction, we continue to work closely with customers and stakeholders to navigate current market conditions and to actively manage the risk inherent to our business. Importantly, our improved performance and liquidity allows us to capture more opportunities in today’s volatile conditions.

“The launch of our Sustainability Report and refreshed ESG strategy represented an important milestone for Puma Energy and the plans we have set out aim to balance the need to support the energy transition to a low-carbon world, with the need to improve access to energy and ensure an equitable and just energy transition.”

ENDS

Notes

Adjusted Key Performance Indicators*

* Excluding Russia (fully divested in January 2022), Myanmar civil aviation (change in consolidation method in 2022 Q1), Angola, Pakistan, Congo DRC and Ivory Coast Abidjan terminal (all divested in 2021)

For press queries, please contact:

Puma Energy Media, Matthew Willey: +44 (0) 7765 000 529 or media@pumaenergy.com

For investor queries, please contact: investors@pumaenergy.com

Further information can be located at: Puma Energy: Investors: Overview

About Puma Energy

Puma Energy is a leading global energy business, safely providing energy across six continents. Its downstream business segments include fuels, aviation, lubricants and bitumen. The company has 1,948 retail sites and it is present at 107 airports. Puma’s purpose is energising communities to help drive growth and prosperity by sustainably serving customers’ needs in high potential countries around the world.

For further information visit: www.pumaenergy.com

Cautionary Statement

This announcement is not being made in and copies of it may not be distributed or sent into any jurisdiction where distribution would be unlawful.

Forward-looking statements

Some of the information included in this announcement contain forward-looking statements. You can identify these forward-looking statements by use of words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “will,” “estimates,” “intends,” “projects,” “goals,” “objectives,” “guidance,” “targets,” “forecasts” or “could”, the negative of such terms and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. Although Puma Energy believes that the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement.

[1] The Voluntary Principles on Security and Human Rights provides set of principles that guides companies on how to conduct their security operations while respecting human rights. The Voluntary Principles on Security and Human Rights : Voluntary Principles on Security and Human Rights