Puma Energy Announces Q2 2023 Results

Stable overall performance across core regions

Continued positive net-income despite challenging macro-economic headwinds

Completion of infrastructure asset divestment process

Singapore, 24 August 2023 – Puma Energy today announced its financial results for the three-month period ended 30 June 2023.

Puma Energy’s performance in the second quarter was curbed by current macro-economic headwinds across select key markets. The business’s overall performance remained stable, underpinned by a strong performance in Latin America compared to a challenging period for Southern and Eastern African markets as they contended with the impacts of US dollar liquidity shortages and local currency volatility.

Despite relatively steady volumes on a constant perimeter basis, the business experienced a decline in EBITDA versus the previous quarter as a result of lower unit margins in Africa due to foreign currency volatility. The business delivered a net profit of USD 31 million in the quarter, excluding IFRS 16. The increase in net profit was largely attributable to the sale of Puma Energy’s terminal in El Salvador to ITG Sàrl, the parent company of Impala Terminals, which contributed a one-off benefit of USD 18 million.

Puma Energy completed its process of divesting a significant part of the company’s storage terminal infrastructure assets. The company’s objective remains to focus on prudent and targeted growth investments in its downstream business, while continuing to actively manage liabilities, costs and inherent market risks.

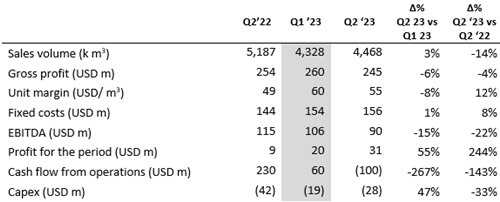

Key Performance Indicators*

*NB All financial figures are presented excluding the impact of IFRS16

*Unadjusted for perimeter changes

Carlos Pons, Chief Financial Officer of Puma Energy, said: “The sale of our terminal in El Salvador concludes the process of divesting our non-core marine infrastructure assets. The completion of this process, coupled with our restored financial stability and competitiveness across key countries marks the next chapter for Puma in which we aim to consolidate our progress and stabilise the business in key markets as well as renew our focus on prudent growth investments.”

“This quarter, despite current macro-economic challenges, the business remained relatively stable as Latin America’s strong performance balanced weaker results in Africa. Some key markets in Africa placed downward pressure on margins due to shortages in US dollar liquidity and local currency volatility. While these market specific challenges are outside of our control, we remain vigilant to the broader implications on the business.

“Importantly, the completion of Puma Energy’s first sustainability linked RCF and Term Loan, for USD 847.5 million was the highest amount for five years and the first time the facilities have included a sustainability component.

“In addition, we made progress in managing the company’s debt maturity profile. Following our successful consent solicitation, in July we announced an offer to purchase USD 410 million of Senior Notes which was completed on 16th August with USD 377.5 million of the USD 600 million Senior Notes due 2024, and Euro 29.6 million of the Euro 200 million amortising Senior Notes due 2024 validly tendered and accepted for buy-backs.”

Quarterly Highlights

Health and safety

Maintaining and enhancing safety standards remains a priority. The Lost Time Injury Frequency Rate for employees and contractors working on Puma Energy sites in the quarter was 0.221. This represents an improvement on 0.38 achieved in the previous quarter. Puma Energy will continue to focus on driving HSSE awareness across the company and in particular in relation to road transport.

Sustainability-Linked RCF and Term Loan

As reported in the previous quarter, Puma Energy’s 2023 Revolving Credit Facility and Term Loan was launched in March and closed in May with facilities representing commitments of USD 847.5 million. This is the highest amount raised over the past five years. The Sustainability-Linked facilities will see margins adjusted subject to Puma Energy achieving independently verified KPIs relating to greenhouse gas emissions reduction as well as security and human rights.

Infrastructure divestment

In line with Puma Energy’s strategy to focus on its core downstream activities, the company’s plans to divest its major marine terminals completed in Q2 2023. The sale of El Salvador to ITG Sarl marks the end of the process and contributed USD 18 million to net profit, after the costs of sale.

Sustainability Strategy 2023

Puma Energy published its Sustainability Strategy 2023 in June. Full details of the company’s sustainability ambitions are detailed in the report. A key update made this year relates to climate change ambitions. The Energy Transition and Climate Change pillar extends the ambition to reduce Scope 1 and 2 GHG emissions beyond 15 per cent by the end of 2025 to 35 per cent by the end of 2032, while also setting a pathway to operational Net Zero by 2050.

Transition Fuels and Clean Energy

In 2023 Puma Energy aims to install a further 100 solar projects across its network, building on the 200 installed by the end of 2022. By the end of the quarter, the company had installed solar power projects at 244 sites with a total operational capacity of 8,875 kW. Using the experience Puma has gained through the installation of clean energy technologies its own assets, it is now in active discussions with several key customers about installing and operating clean energy solutions at their facilities.

Capital Structure

After a significant reduction in the Company’s gross and net debt in 2022, gross debt rose this quarter as a result of increased operating company debt which rose from USD 120 million in Q1 to USD 143 million in Q2 as a result of efforts to manage FX shortages in Tanzania and Mozambique. The quarter also saw a USD 90 million draw down on the Revolving Credit Facility which was used to facilitate the prepayment of fuel supply in order to secure better terms and conditions. Senior Notes decreased by USD 29.6 million as a result of open market bond repurchases. Based on a standard definition of net debt, excluding inventories and net of cash, net debt stood at USD 831 million or 2.2 x LTM EBITDA2.

2024 Notes Offer to Purchase

Following the successful consent solicitation relating to the Company’s 2026 notes announced on 9 June 2023, on 18 July Puma Energy announced a USD 410 million offer to purchase its 5.125% U.S. dollar-denominated Senior Notes due 2024 and its 2.650% Euro-denominated Amortizing Senior Notes due 2024. The solicitation was completed on 16th August with USD 377.5 million of the USD 600 million Senior Notes due 2024, and Euro 29.6 million of the Euro 200 million amortising Senior notes due 2024 validly tendered and accepted for buy-backs.

Working Capital and liquidity

The reduction in working capital to USD -167 million resulted from a planned pre-payment to fuel suppliers, with the aim to improve profitability.

Subsequent Event

On 1st of August 2023, Puma Energy completed the acquisition of AirBP assets in Mozambique. This acquisition will boost Puma Energy’s aviation presence across seven airports.

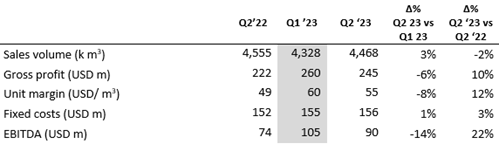

Key Performance Indicators Constant Perimeter3

1LTIFR figure records the rate of injuries to employees and Mode 1 and 2 contractors as defined by the International Organisation of Oil and Producers (IOGP).

2 Net Debt as per standard definition (gross debt minus cash and equivalents). Puma Energy’s covenants require a net debt to EBITDA ratio of >3.5x including inventories and on this basis the ratio of net debt to EBITDA LTM stood at 0.02x, well below the covenant threshold.

3 Q1 2022 figures adjusted for perimeter changes.

ENDS

For press queries, please contact:

Puma Energy Media

Matthew Willey

Tel.: +44 (0) 7765 000 529

Email: media@pumaenergy.com

For investor queries, please contact:

investors@pumaenergy.com

About Puma Energy

Puma Energy is a leading global energy business, safely providing energy across six continents. Our downstream business segments include fuels, aviation, lubricants and bitumen. Our purpose is energising communities to help drive growth and prosperity by sustainably serving our customers’ needs in high potential countries around the world.

For further information visit: www.pumaenergy.com

Cautionary Statement

This announcement is not being made in and copies of it may not be distributed or sent into any jurisdiction where distribution would be unlawful.

Forward-looking statements

Some of the information included in this announcement contain forward-looking statements. You can identify these forward-looking statements by use of words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “will,” “estimates,” “intends,” “projects,” “goals,” “objectives,” “guidance,” “targets,” “forecasts” or “could”, the negative of such terms and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. Although Puma Energy believes that the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement.