Chasing rainbows

For a colourless gas, hydrogen has lots of colours...

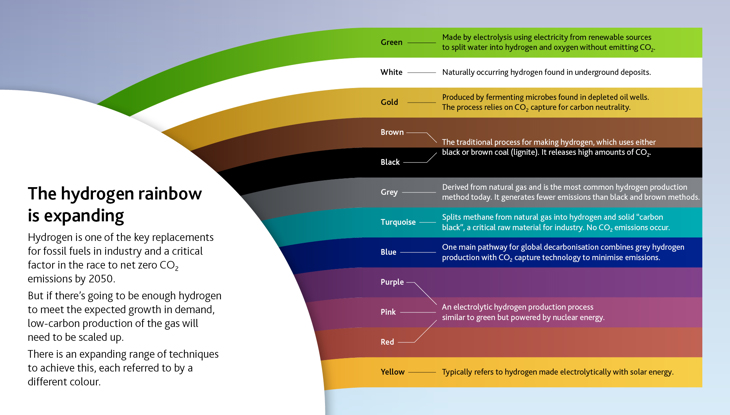

From grey to green and blue to brown, colour codes have been used to distinguish between different types of hydrogen. These are often referred to as the ‘rainbow’ of hydrogen production pathways.

Green hydrogen, for example, is made using renewable energy to electrolyse water, while blue hydrogen is produced from natural gas with the carbon dioxide produced as a by-product captured and stored.

These colour codes have played a useful role in helping people understand the value of investing in hydrogen and its role in the energy transition and decarbonising hard-to-abate industries. But they have limitations.

For one thing, they lack nuance.

Hydrogen made through the electrolysis of water is not necessarily ‘lower carbon’ than ‘blue’ hydrogen, if it produced from a grid that use thermal coal to generate electricity.

Colour codes are a distraction and run the risk of creating a fragmented market.

One unintended consequence of the focus on colour has been to create rival camps (blue versus green hydrogen for example) that argue among themselves instead of recognising that we will need all types of hydrogen in the energy transition and that production methods will vary from region to region and industry to industry.

As such, we need to stop chasing rainbows and focus on scaling up hydrogen in a technology agnostic way so that it can make a meaningful contribution to meeting the goals of the Paris Agreement on Climate Change.

After all, the planet does not care how carbon emissions are reduced, just that they are reduced.

Hydrogen has a key role to play in the energy transition as an alternative to fossils fuels, particularly in hard to abate industries, such as heavy-duty transport (trucking, shipping, aviation), cement, steel or petrochemicals, where electrification is not feasible.

But the fuel is still relatively expensive to make and therefore governments are trying to find ways to support its development and adoption.

One way that this can be achieved is by moving beyond colours and focusing on carbon intensity when it comes to setting standards, subsidies and credits.

Take President Biden’s USD369 billion clean energy package. The Inflation Reduction Act (IRA) takes a ‘colour agnostic’ approach to promoting hydrogen. A USD3.00 per kilogramme tax credit is awarded to any hydrogen producer who can demonstrate carbon emissions lower than 0.45 per kilogramme of carbon dioxide (CO2) per kilogramme of hydrogen. Lower subsidy levels apply to higher carbon intensity values.

This type of approach has already proved to be a success in California, which has long been a trailblazer in environmental regulation.

The state’s Low Carbon Fuel Standard (LCFS) focuses strictly on a fuel’s carbon intensity on a full lifecycle basis to determine the quantity of greenhouse gas (GHG) reduction credits awarded to the fuel retailer.

And to support its energy security strategy, the UK government has defined what constitutes ‘low carbon hydrogen’ at the point of production, setting a threshold of 4kg of CO2 per kilogramme of hydrogen. This threshold can be met via multiple H2 production pathways.

The EU is the one region which has decided to promote a particular production pathway, green hydrogen. But even here carbon intensity is important.

In order to qualify for the designation or classification of a Renewable Fuels of Non-Biological Origin (RFNBO), a hydrogen producer must demonstrate a 70% GHG savings vs a fossil fuel benchmark. They must also demonstrate that the hydrogen production plant consumes additional renewable electricity, along with temporal and geographic correlation requirements. These rules are defined under the recent Delegated Act which lays out the criteria for certified RFNBO production.

This is relevant because the EU sets sub-quotas for RFNBO consumption in certain sectors. For example, under the recently agreed revision of the Renewable Energy Directive, the EU has mandated that that 42% of the hydrogen used in industry should come from RFNBOs by 2030, and 60% by 2035.

The EU is also promoting alternative sources of hydrogen. As long as the H2 can demonstrate a 70% GHG reduction vs. the benchmark, other low carbon H2 sources will be eligible for government support in hard to abate sectors, such as refineries, petrochemicals, and steel. These low carbon molecules may be subsidised but won’t benefit from the same subsidy premium than an RNFBO, the same way the IRA will compensate higher carbon saving with a larger tax credit. In addition, ongoing negotiations around the Carbon Border Adjustment Mechanism (CBAM) suggests that certain imported goods and fuels will need to report on the carbon intensity of the imported good, reinforcing the trend towards carbon intensity and emission values rather than colour-based for hydrogen.

Ultimately, the only way to successfully commoditise hydrogen is to avoid fixating on specific colours and focus on the standardisation of emission scoring and carbon intensity values.

We need to look beyond the rainbow and impress on policymakers and industry players the need to start investing in hydrogen adoption today if we are to have any hope of limiting global warming to 1.5C.

Visual reinterpretation of Mitsubishi Heavy Industries Group's Hydrogen Colour Wheel (Source)

Watch my recent interview on this topic at CERAWeek 2023.