Trafigura Group Pte Ltd Signs USD2.27 Billion European Multicurrency Syndicated Revolving Credit Facility

Geneva, 23 March 2017 – Trafigura Group Pte Ltd. (“Trafigura” or the “Company”), a market leader in the global commodities industry, has successfully signed a new 364-day multi-currency syndicated revolving credit facility (the “364-day RCF”) totalling USD2.27 billion. The 364-day RCF, initially launched at USD1.5 billion, was very well received by invited banks and closed substantially oversubscribed, allowing the Company to upsize the facility.

The 364-day RCF will be used to refinance the maturing USD1.91 billion 364-day tranche of the Company’s existing USD5.1 billion facility dated 24th March 2016, as well as for general corporate purposes.

Christophe Salmon, Chief Financial Officer for Trafigura, commented: “We have re-financed the facility at pricing levels in line with 2016 and with a larger and more diverse bank group. We are grateful for the support that the banking community has shown to Trafigura once again and we are pleased to welcome new banks to both the 1-year refinanced facility and the 3-year extended facility.”

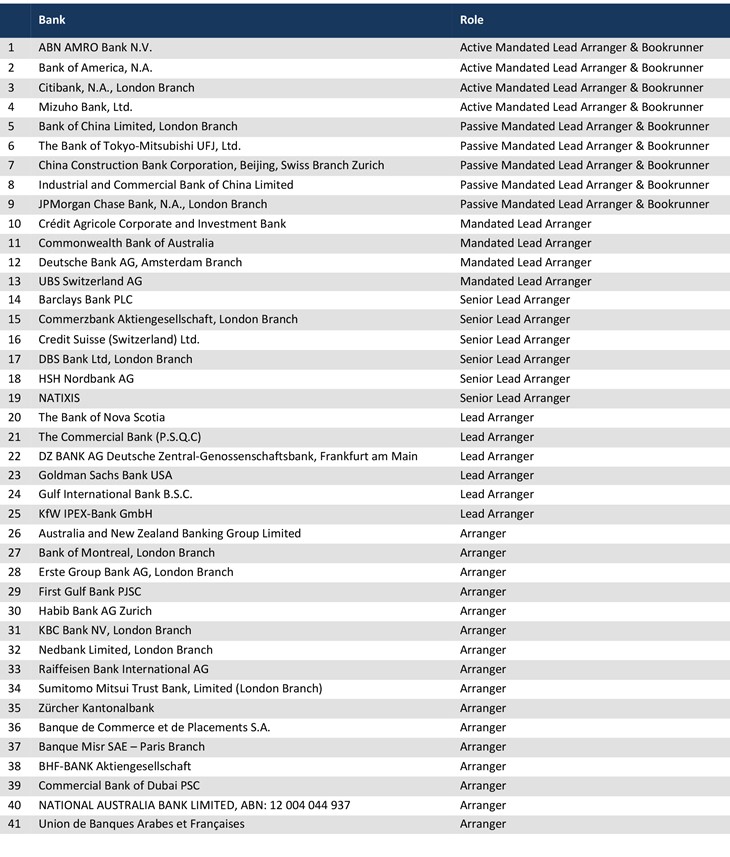

The facility was arranged by Mandated Lead Arrangers & Bookrunners ABN AMRO Bank N.V., Bank of America Merrill Lynch, Citigroup Global Markets Limited and Mizuho Bank, Ltd. acting as Active Bookrunners, with Bank of China Limited, London Branch, MUFG, China Construction Bank Corporation Beijing, Zurich Branch, Industrial and Commercial Bank of China Limited, London Branch, and J.P. Morgan joining acting as Passive Bookrunners. In addition to the nine Mandated Lead Arrangers & Bookrunners, four Mandated Lead Arrangers and 28 additional financial institutions joined the RCF during syndication, totalling 41 banks, including seven new banks compared to last year.

Concurrently the Company decided to extend rather than refinance the 3-year tranche of its existing USD5.1 billion syndicated revolving credit facility. Trafigura exercised the first extension option available on its existing syndicated revolving credit facility (the “3-year RCF”) which was originally put in place on 24th March 2016.

ENDS

For further information please contact:

Trafigura’s Global Press Office: +41 (0) 22 592 4528 or media@trafigura.com

Notes to editors

Founded in 1993, Trafigura is one of the largest physical commodities trading groups in the world. Trafigura sources, stores, transports and delivers a range of raw materials (including oil and refined products and metals and minerals) to clients around the world. The trading business is supported by industrial and financial assets, including 49.6 percent owned global oil products storage and distribution company Puma Energy; global terminals, warehousing and logistics operator Impala Terminals; Trafigura's Mining Group; 50 percent owned DT Group which specialises in logistics and trading; and Galena Asset Management. The Company is owned by around 600 of its 4,100 employees who work in 61 offices in 36 countries around the world. Trafigura has achieved substantial growth over recent years, growing revenue from USD12 billion in 2003 to USD98.1 billion in 2016. The Group has been connecting its customers to the global economy for more than two decades, growing prosperity by advancing trade.

Visit: www.trafigura.com

Banks providing the RCF: