Trafigura publishes 2022 half year results showing another strong performance in challenging times

Singapore, 10 June 2022 – Trafigura Group Pte. Ltd. (“Trafigura” or “the Group”), a market leader in the global commodities industry, released its half year results today for the six-month period ending 31 March 2022. The results show another strong performance in extremely challenging times in global markets that featured heightened volatility, continued supply chain disruptions and, from 24 February 2022, war in Ukraine.

“Trafigura’s global and diversified business footprint, market knowledge and customer relationships, logistical skills and robust balance sheet were all significantly tested,” said Trafigura’s Executive Chairman and Chief Executive Officer Jeremy Weir. “These qualities are also required more than ever by our customers during periods of seismic change in commodity markets, and the last few months have been no exception. I am pleased to report that Trafigura successfully navigated these challenges to achieve another strong commercial performance and a record profit for the period.”

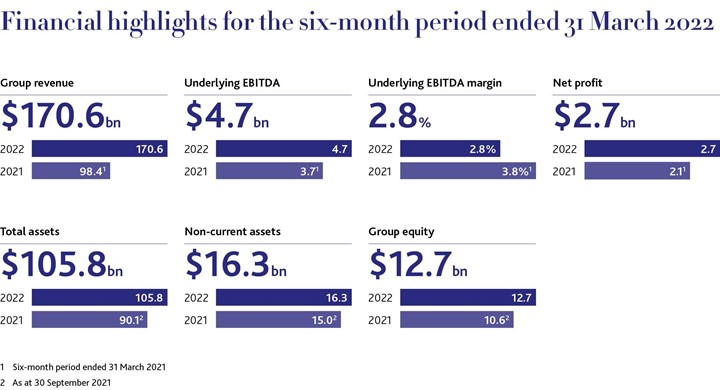

Trafigura’s net profit for the period was USD2.7 billion, a 27 percent increase over the first half of the 2021 financial year, with both principal operating segments contributing to the record result. Higher average commodity prices and traded volumes generated a 73 percent increase in revenues to USD170.6 billion. Underlying EBITDA rose 26 percent to USD4.7 billion from USD3.7 billion in the first half of 2021.

Market disruptions placed a premium on Trafigura’s logistical skills and market knowledge in helping customers to reorder their supply chains. As a result, trading volumes increased across the board. Oil and petroleum products volumes increased by 14 percent compared to the first half of 2021, to an average of 7.3 million barrels per day, while non-ferrous metals volumes grew by 16 percent and bulk minerals volumes by 13 percent.

Trafigura secured increased access to liquidity throughout the half-year, to support the increased levels of volatility in global markets, in particular after the outbreak of the war in Ukraine. Total credit lines reached a record level of USD73 billion, excluding Puma Energy, from a network of around 140 financial institutions, of which USD7 billion was raised over the last six months. The Group’s commitments to transparency, open engagement with stakeholders and high standards of ethical and responsible conduct have been pre-requisites to achieving this success and support from the financial sector.

The period included a number of key transactions. Puma Energy, now fully consolidated within the Group after the buyout of its Angolan shareholders, is being streamlined under new management, including agreeing the sale of its infrastructure business during the period. In February 2022, the sale of Spanish mining joint venture Minas de Aguas Tenidas (MATSA) was completed.

The Group ceased all trading of crude oil with sanctioned Russian organisations in advance of the European Union and Swiss sanctions taking effect on 15 May 2022, while substantially reducing the volume of oil products from sanctioned Russian organisations to solely supply essential fuels required by European customers. Trafigura will continue to comply in full with all applicable subsequent sanctions packages. In addition, the Group froze its investments in Russia and announced a review of its ten percent non-operational, passive shareholding in Vostok Oil, with the intention of exiting.

Trafigura continued to grow its power, renewables and carbon trading operations, and to invest in projects to support the energy transition. Joint venture Nala Renewables with IFM Investors, acquired a large portfolio of solar projects in Chile and a further four projects to construct battery energy storage systems in the United States. The growing carbon team completed a landmark transaction, investing in the large‑scale Delta Blue Carbon mangrove restoration project in the Indus Delta in Pakistan as the anchor offtaker of high quality carbon removal credits.

Through Trafigura’s joint venture with H2 Energy, plans are progressing to build a 1GW green hydrogen electrolyser in Denmark to fuel trucks and other heavy land-based transport. In addition, 250 green hydrogen retail refuelling stations are being developed in Austria, Denmark and Germany together with Phillips 66, the owner of JET® branded stations in Europe. In Australia, a study is progressing to develop a commercial scale green hydrogen manufacturing facility at Nyrstar’s Port Pirie site and in Norway, Trafigura is part of a consortium together with Hy2gen and Copenhagen Infrastructure Partners to produce green ammonia for the shipping sector in a project that is expected to be operational in 2027.

Outlook

In the second half of the financial year, the lack of depth available in the commodities futures markets looks set to continue to be a challenge for the industry, as reduced access to derivatives for all participants in turn puts pressure on the ability to move physical commodities. Further headwinds include continued geo-political turbulence and a more challenging macro-economic outlook in many of the Group’s key markets. Nonetheless, robust profitability and strong business performance is expected in the second half of the 2022 financial year.

“Looking ahead, we see no let-up in the challenging market conditions. Global supply chains remain disrupted and the geopolitical situation will continue to be turbulent. However, Trafigura has proved yet again that its business and global platform are resilient and agile to adapt rapidly to difficult market conditions. I am confident that this will continue to be the case for the full year,” concluded Jeremy Weir.

ENDS

To watch a video interview with Christophe Salmon, Trafigura’s Group CFO about the half year results and to download a copy of Trafigura’s H1 results click here.

For further information please contact:

Trafigura’s Press Office: +41 (0) 22 592 45 28 or media@trafigura.com

Notes to editors

Founded in 1993, Trafigura is one of the largest physical commodities trading groups in the world. At the heart of global supply, Trafigura connects the world with the vital resources it needs. Through our Oil & Petroleum Products, Metals & Minerals, and Power & Renewables divisions, we deploy infrastructure, skills and a global network to move commodities from where they are plentiful to where they are needed most, forming strong relationships that make supply chains more efficient, secure and sustainable.

Trafigura also owns and operates a number of industrial assets including a majority share of global multi-metals producer Nyrstar and fuel storage and distribution company Puma Energy; and joint ventures Impala Terminals, a port and logistics provider, and Nala Renewables, a power and renewable energy investment and development platform. Trafigura is owned by its employees and employs over 13,000 people working in 48 countries.

Visit: www.trafigura.com