Puma Energy Announces Q3 2023 Results

Solid performance across regions and core segments

Strong cash generation driven by underlying operational performance and working capital release

Year-to-date net income remains positive despite negative results in Q3 due to one-offs and impairments

USD 358 million existing shareholder loan converted into equity

Singapore, 23 November 2023 – Puma Energy today announced its financial results for the three-month period ended 30 September 2023.

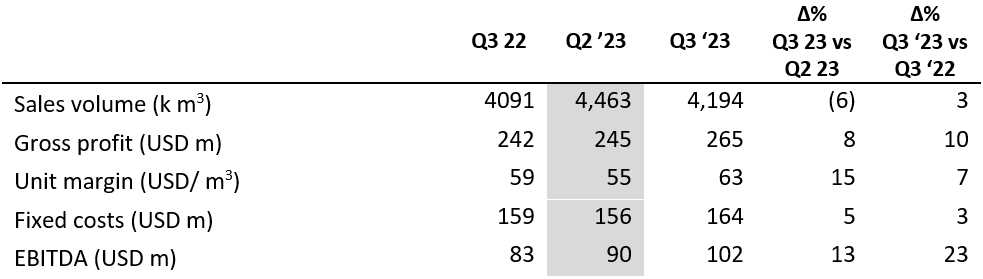

Puma Energy’s performance in the third quarter remained solid as the company continued to navigate macro-economic headwinds. On an adjusted perimeter basis, removing the impact of the sale of the infrastructure assets, volumes were up compared to the same quarter in 2022 but down relative to the previous quarter as a result of lower spot sales in the supply segment. Despite lower overall volumes, profitability increased compared to the previous quarter due to improved volume sales from aviation and commercial.

Gross profit rose from USD 245 million to USD 265 million and EBITDA rose from USD 90 million last quarter to USD 102 million. In addition, operating cash flow increased due to improved underlying performance and operational working capital release as a result of no fuel prepayments this quarter.

As previously announced, the sale of Puma Energy’s terminal in Puerto Rico is not proceeding. The transfer of the terminal from Discontinued Operations to Continued Operations and an impairment on Puma Energy’s Estonian assets contributed USD 34 million to the USD 37 million net loss in the quarter, excluding IFRS 16. Despite the depreciation and impairments, the Company remains profitable for the year to date with a net profit of USD 14 million.

USD 358 million of the company’s existing shareholder loan was converted into equity on 1 October 2023. This resulted in a stronger equity base.

Key Performance Indicators*

*NB All financial figures are presented excluding the impact of IFRS16

*Unadjusted for perimeter changes

Carlos Pons, Chief Financial Officer of Puma Energy, said: “Overall this was a solid quarter for Puma Energy, despite continuing macro-economic challenges which we continue to monitor carefully. The successful completion of our USD 410 million liability management this quarter is a clear demonstration of our focus on strengthening the capital structure of the company.”

Quarterly Highlights

Health and safety

Maintaining and enhancing safety standards remains a priority. The Lost Time Injury Frequency Rate for employees and contractors working for Puma Energy in the quarter was 0.121. This represents an improvement on 0.22 achieved in the previous quarter. Puma Energy will continue to focus on driving HSSE awareness across the company and in particular in relation to road transport.

Transition Fuels and Clean Energy

In 2023 Puma Energy aims to install a further 100 solar projects across its network, building on the 200 installed by the end of 2022. By the end of the quarter, the company had installed solar power projects at 287 sites with a total operational capacity of 10,494 kW. Using the experience Puma has gained through the installation of clean energy technologies at its own assets, it is now in active discussions with several key customers about installing and operating clean energy solutions at their facilities.

Liability Management Exercise

Puma Energy’s offer to purchase USD 410 million of Senior Notes was completed on 16 August, with USD 377.5 million of the USD 600 million Senior Notes due 2024, and Euro 29.6 million of the Euro 200 million amortising Senior Notes due 2024, validly tendered and accepted for buy-backs. The company intends to call all remaining 2024 Senior Notes by the end of the year unless any unexpected force majeure occurs.

Capital Structure

Gross debt reduced from USD 1,643 million in the previous quarter to USD 1,146 million this quarter as a result of the USD 410 million liability management exercise in August and solid cash generation which allowed for a reduction in debt at operating companies level. The Company’s Revolving Credit Facility remained undrawn at the end of the quarter. In terms of liquidity, the Company benefited from USD 567 million of cash and circa USD 650 million of committed RCF undrawn. Based on a standard definition of net debt, excluding inventories and net of cash, net debt stood at USD 579 million or 1.5 x LTM EBITDA2.

Mergers and Acquisitions

This quarter Puma Energy announced the sale of its LPG and Retail business in Senegal to Oryx for USD 11 million proceeds.

Key Performance Indicators Constant Perimeter3

ENDS

1 LTIFR figure records the rate of injuries to employees and Mode 1 and 2 contractors as defined by the International Organisation of Oil and Producers (IOGP).

2 Net Debt as per standard definition (gross debt minus cash and equivalents). Puma Energy’s covenants require a net debt to EBITDA ratio of >3.5x including inventories and on this basis the ratio of net debt to EBITDA LTM stood at (0.8)x, well below the covenant threshold.

3 Q3 2022 & 2023 figures adjusted for perimeter changes.

For press queries, please contact:

Puma Energy Media

Matthew Willey

Tel.: +44 (0) 7765 000 529

Email: media@pumaenergy.com

For investor queries, please contact:

investors@pumaenergy.com

About Puma Energy

Puma Energy is a leading global energy business, safely providing energy across six continents. Our downstream business segments include fuels, aviation, lubricants and bitumen. Our purpose is energising communities to help drive growth and prosperity by sustainably serving our customers’ needs in high potential countries around the world.

For further information visit: www.pumaenergy.com

Cautionary Statement

This announcement is not being made in and copies of it may not be distributed or sent into any jurisdiction where distribution would be unlawful.

Forward-looking statements

Some of the information included in this announcement contain forward-looking statements. You can identify these forward-looking statements by use of words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “will,” “estimates,” “intends,” “projects,” “goals,” “objectives,” “guidance,” “targets,” “forecasts” or “could”, the negative of such terms and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. Although Puma Energy believes that the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement.