What we do

Bringing efficiency to complex supply chains

At the heart of global supply, Trafigura connects producers and consumers of vital commodities - efficiently, reliably and responsibly. Across our global network, we deploy infrastructure, logistics and our deep understanding of markets to supply the resources needed to power and build the world.

Expertise every step of the way

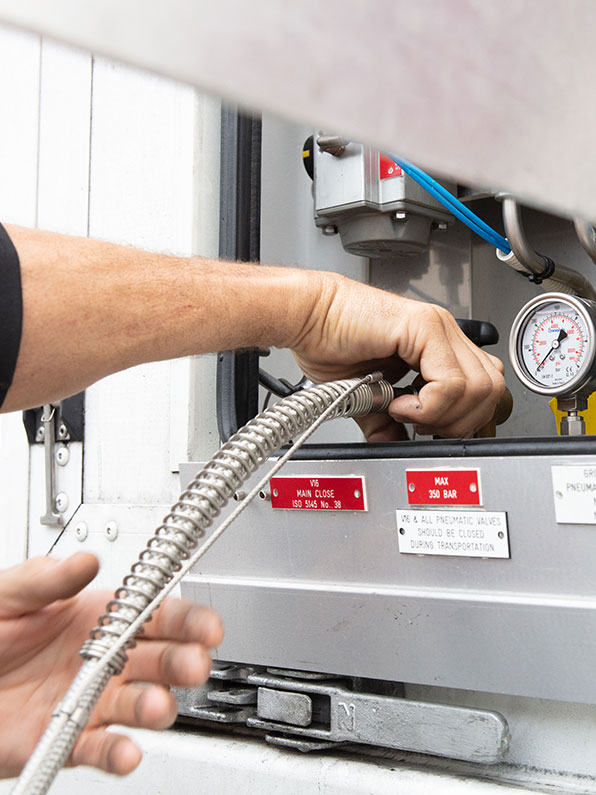

Optimizing complex supply chains

Trafigura specialises in the complex task of supplying critical resources where and when they are needed. We are present every step of the way, from the point of production to the point of consumption, helping to make global supply chains more efficient, secure and sustainable.

Connecting producers and consumers through efficient supply chains

Connecting producers and consumers through efficient supply chains

Helping our customers to power and build the world

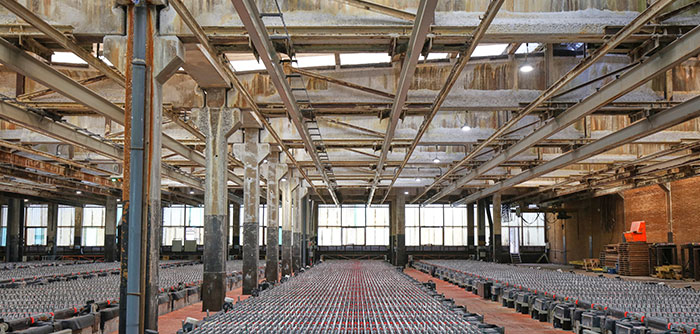

Assets And Investments

Our business is supported by key assets and investments

Trafigura invests in assets and entities that help facilitate the supply, processing and transportation of physical commodities and energy around the world.

Our Group

Our group companies and joint ventures

Trafigura owns 49% or more of the following companies and joint ventures.

You may also be interested in

Explore our publications and get

the latest news and insights.