Puma Energy announces Q4 2021 results

Singapore, 17 March 2022 – Puma Energy today announced its financial results for the three-month period and full year ended 31 December 2021.

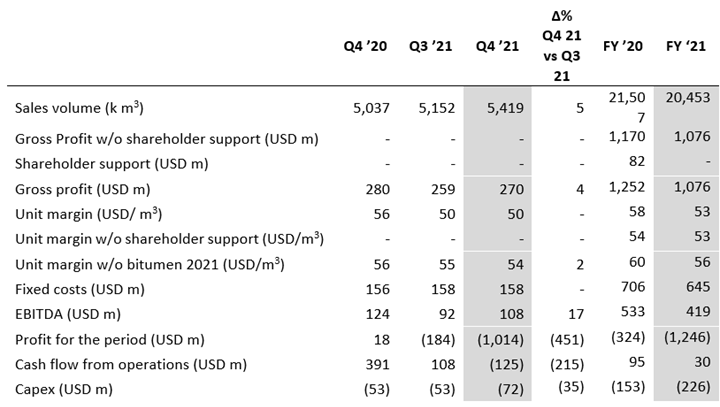

The fourth quarter of 2021 saw gross profit and EBITDA trend higher relative to Q3 as the company’s focus on core downstream markets started to materialise and the recovery from COVID-19 continued. Gross debt was reduced by USD 792 million over the course of 2021 and the company finished the year with a positive equity of USD 182 million. Over the full year, the company increased capital investment into the business with a focus on health and safety, maintenance and improving our downstream retail network. Download the Annual Report here.

Key Performance Indicators*

Highlights Full Year 2021

Health and safety

- Good safety performance continued. The Lost Time Injury Frequency Rate was 0.14 in 2021, down from 0.47 in 2020, a 70 per cent improvement.

Strengthened balance sheet

- Puma Energy significantly strengthened its balance sheet in 2021 with gross debt reduced by USD 792 million to USD 1,946 million and net debt reduced to USD 472 million, a record low net debt to EDITDA ratio of 1.1

- The Company finished the full year with positive equity of USD 182 million (as per IFRS).

Simplified the business

- On 16 December, Puma Energy completed the sale of its business in Angola for USD 600 million.

- In line with its plans to focus on core downstream competences, on 14 March 2022 Puma Energy announced it has agreed to sell a significant part of its infrastructure and storage business to ITG Sàrl, the parent company of Impala Terminals, subject to a number of material commercial and regulatory approvals.

- As of 31 December 2021, Trafigura’s shareholding in Puma Energy totaled 96.6 per cent.

---------------------------------------------

- The net debt to EBITDA ratio of x1.1 is net of inventories as per our banking covenants.

- Trafigura’s shareholding rose to 96.6% as a result of its acquisition of Sonangol’s shares in Puma Energy and the fact that Cochan Holdings LLC ceased to be a shareholder in Puma Energy Holdings Pte Ltd on 28 December 2021.

Focused on core downstream retail

- Investment in core downstream markets continued in 2021 with the opening of 68 new service stations, 150 forecourts retrofits, and opening or upgrades of 112 Super 7 convenience stores. In 2021, the company installed solar power projects at 37 sites with a total operational capacity of 1,302 kWp. The company also invested in our aviation business and, as at 31 December 2021, it served 103 airports, up from 87 in 2020.

Financial Performance in Q4

- Gross profit rose to USD 270 million in Q4 up from USD 259 million in Q3.

- EBITDA rose to USD 108 million in Q4 up from USD 92 million in Q3 driven by higher volumes and stable fixed costs.

- Sales volumes in Q4 were 5,419,000m3 up from 5,152,000m3 in Q3.

- Unit margins remained at USD 50 per m3 in Q4, the same level as the previous quarter due to lower margins in the bitumen business but this was partially offset by higher margins in retail and commercial.

- Loss for the quarter of USD 1,014 million was caused by the accumulated foreign exchange translation losses on the divested Angolan business.

- Cash flow from operations were negative, at USD 125 million, in Q4 due to change in working capital as a result of the regularisation of payment terms with Trafigura.

Commenting on the results, Hadi Hallouche CEO, said:

"The last quarter of 2021 saw an increase in sales volumes, gross profit and EBITDA. This positive performance was driven by the ongoing post-COVID-19 recovery, investment across our retail station network in high potential downstream markets and a focus on securing new aviation customers at airports around the world.

"The war in Ukraine and recovery from COVID-19 are reshaping global energy flows and creating price volatility. However, Puma Energy’s global presence and mix of regulated and unregulated markets means that we are well positioned to mitigate potential impacts on our margins. In addition, our successful integration with Trafigura will help ensure we have flexible and competitive access to supply in an increasingly constrained market.

"The roll out of solar PV projects across our terminals and retail stations was a particular highlight in 2021 and the experience we gained will be invaluable as we diversify our portfolio and support our customers and partners with cleaner energy solutions.”

ENDS

For further information, please contact:

Puma Energy Media, Matthew Willey: +44 (0) 7765 000 529 or media@pumaenergy.com

For investor queries, please contact: investors@pumaenergy.com

Further information can be located at: Puma Energy: Investors: Overview

About Puma Energy

Puma Energy is a leading global energy business, safely providing energy across six continents. Our downstream business segments include fuels, aviation, lubricants and bitumen. We have 1,998 retail sites and we are present at 107 airports. Our infrastructure business includes a network of storage terminals with a capacity of 6.7 million m3. Our purpose is energising communities to help drive growth and prosperity by sustainably serving our customers’ needs in high potential countries around the world.

Visit: www.pumaenergy.com

Cautionary Statement

This announcement is not being made in and copies of it may not be distributed or sent into any jurisdiction where distribution would be unlawful.

Forward-looking statements

Some information included in this announcement contain forward-looking statements. You can identify these forward-looking statements by use of words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “will,” “estimates,” “intends,” “projects,” “goals,” “objectives,” “guidance,” “targets,” “forecasts” or “could”, the negative of such terms and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. Although Puma Energy believes that the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement. Accordingly, no representation or warranty, express or implied, is made or given by or on behalf of Puma Energy or any of its directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this announcement.